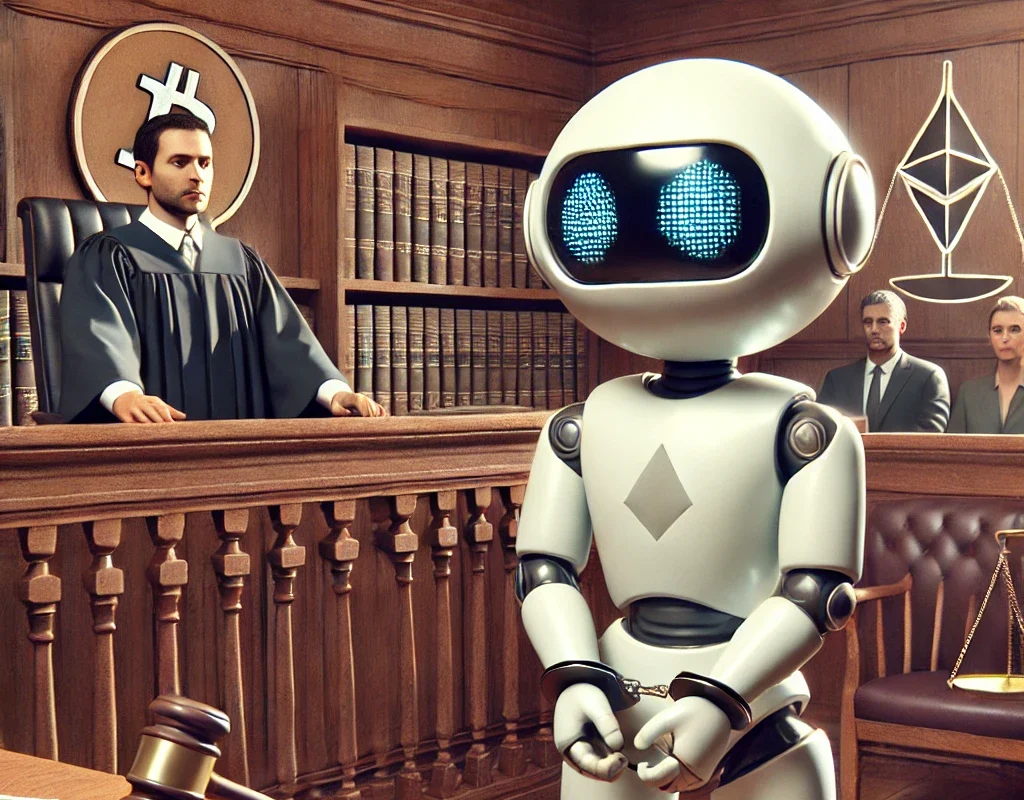

if you want an immediate answer no, using Ai Crypto Trading Bots Are not Illegal. but it has more to it. issue of using artificial intelligence in the financial markets is very controversial in terms of its compliance with the law and regulations. It raises the question whether the use of artificial intelligence and then trading robots is legal or not? In this article, we will examine the legal aspects of using trading robots, artificial intelligence in trading, as well as regulations related to digital currencies. So, let’s dive right in.

you can have more info about crypto trading bots at What Are Crypto Trading Bots and How Do They Work?

Global Overview of Cryptocurrency Regulations

The rules related to crypto currency varies regions to regions. While some lawmakers consider crypto as a valid property and have established legal frameworks to its transactions, others may have adopted a more restrictive and cautious approach towards it that induces complex perspective to crypto trading and trading bots.

Legal implications of AI-driven trading strategies

As mentioned previously, the legality of AI trading varies from country to country. However, the use of these tools is generally neutral, and their legality depends on how they are employed. For example, market manipulation and insider trading are prohibited regardless of whether AI is involved. It is crucial that AI trading complies with the regulations of the region in which it is used.

Crypto Trading Bot Regulations in Key Countries

United States

The United States has experienced a lot of fluctuations in the use of crypto trading bots. The Securities and Exchange Commission (SEC) is an organization that supervises the legal uses of these robots how they can operate. They’ve banned some bot operators that’ve tried to disobey the rules, have made them paying fines and other punishments.

The SEC has also established some rules on how to launch a new cryptocurrency, called an Initial Coin Offering (ICO), without disobeying the law.

European Union

Europe has its own set of rules for crypto trading bots, laid out in something called MiFID II and backed up by the ESMA. These regulations are like a complex puzzle that traders and bot builders need to solve. The main idea is to keep things fair and protect investors.

United Kingdom

The UK’s financial watchdog, the FCA, is the leader when it comes to rules related to the crypto currency. They’ve recently tightened the screws on crypto trading bots, laying out new guidelines to make sure everyone trade fair.

Japan

Japan is another country where crypto rules are quite strict. The Financial Services Agency (FSA) is the referee, and they’ve set up a special license for crypto exchanges. This means if you want to use a trading bot in Japan, it needs to be part of a licensed exchange.

South Korea

South Korea is another country that’s taking a serious approach to crypto trading bots. The Financial Services Commission (FSC) is responsible for financial aspects. Their main goal is to protect investors and make sure the market plays fair. If you’re planning to use a bot in South Korea, you better make sure it follows the FSC’s rules.

India

India’s taken a “wait and see” approach to crypto, including trading bots. The Reserve Bank of India (RBI) is the country’s financial responsible, and they’ve been a bit hesitant about supporting digital currencies. They’ve issued some guidelines to try and keep things in check, mainly focusing on stopping money laundering and making sure people don’t get ripped off. But the rules are still being figured out, so it’s a bit of a wild card for crypto traders and bot operators.

The Moral Maze of Automated Trading

Fairness of Using Trading Bots

The use of crypto trading bots has sparked considerable discussion about fairness in the market. While some believe these automated tools level the playing field for smaller investors, others express concerns about their potential to create an uneven advantage.

Market Manipulation with Bots

Unfortunately, crypto trading bots can be used for bad and illegal purposes. Activities such as pump-and-dump schemes and wash trading can artificially inflate or deflate prices, harming other market participants. Regulatory bodies are increasingly vigilant in detecting and preventing these harmful practices.

How Exchanges Are Addressing Bot Usage Concerns

Recognizing the potential risks associated with trading bots, many cryptocurrency exchanges have implemented measures to protect market integrity. These include monitoring for suspicious trading activities, requiring transparency from bot users, and imposing restrictions on trading speeds or order volumes.

Choosing a Legal and Compliant Crypto Trading Bot

Choosing a proper crypto trading bot needs a careful consideration of several key factors:

- Legal and regulatory compliance: Ensure the bot complies the laws and regulations of your country.

- Reputation and track record: Research the bot provider’s background and reputation within the industry.

- User-friendliness and customization: Choose a bot that aligns with your trading experience and preferences.

- Security and data privacy: Prioritize platforms that prioritize the protection of your sensitive information.

- Customer support and user feedback: Consider the quality of support provided by the bot provider.

you can read more about The Best AI Crypto Trading Bots You Need to Know.

To decrease risks and build trust, it is important to opt a trading bot provider committed to transparency and accountability. This includes clear communication about trading strategies, fees, and potential conflicts of interest. Several trading bots have provided frameworks based on compliance, security, and user friendliness. Some examples of them include MetaSet, 3Commas, Cryptohopper, Gunbot, HaasOnline, and TradeSanta.